We use the term “utilities costs” (also called “ancillary costs”, if we want to be technically correct) to refer to the costs that the tenant has to pay in addition to their monthly rent. These are operational costs related to the use of the rented premises.

There are 2 types of utilities costs

1. Common area maintenance (also known as CAM) and other general costs. These costs are needed in order to maintain the general operational quality of the building and commonly used spaces like corridors, elevators etc. Typical examples here include elevator maintenance, cleaning of common spaces, building security etc.

2. Individual utilities consumption, e.g. electricity, gas, water. These costs are consumed directly by the tenant and nowadays usually measured by meters. Individual consumption can vary a lot depending on the tenant’s business. For example, restaurants and gyms usually have high water consumption, IT-companies and grocery stores have higher electricity consumption, etc.

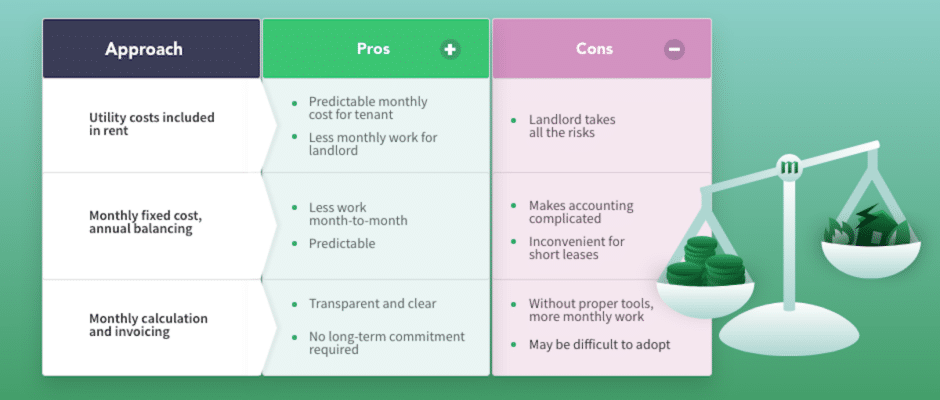

All in all, there are three common approaches to calculating and invoicing utilities costs. However, these mostly concern CAM and general costs. Individually consumed utilities are almost always metered and billed directly to tenant.

3 different approaches to calculating utilities

- Included in rent – most popular with serviced spaces as well as in Asia.

- Monthly fixed rate agreed for a year and balanced once at the end of the year – a typical standard in German-speaking and other Western European countries

- Monthly calculation and invoicing – a typical standard in Eastern Europe and other countries with a less stable history of commercial relations.

The pros and cons of these approaches

1. Included in rent

Utilities included in rent are used mostly for smaller, predictable premises (offices, especially small ones), where individual utilities consumption is not high. Alternatively, this approach is also used when tenants contract directly with the utilities providers (electricity, water, gas, etc.), which is common practice for major consumers like large warehouses or production companies who have the size to negotiate their own prices.

Pros

- A predictable monthly cost is convenient for the tenants

- Less monthly work for the landlord

Cons

- The landlord takes all the risks, thus has to have a very strong understanding of cost trends and dedicate special attention to achieve efficiency.

2. Monthly fixed cost and annual balancing

This approach typically means that landlord and tenant agree on a fixed monthly rate for utilities for a period of one year. The landlord makes a balancing calculation after the year is over and, based on the results, a new monthly rate is agreed for the following year.

Monthly fixed utilities pricing and annual balancing is pretty much the standard for residential properties in Germany. However, it requires a tradition of longer leases and a stable economic environment. Both the tenant and the landlord must be able to trust each other with some of their money for a long period of time (often more than 1 year).

From the accounting perspective, however, it is a pain. Both parties have to keep an estimated reserve to cover potential excess cost. For example, in Germany, the balancing is sometimes done 11-12 months after the year ends, which means you may be getting an extra invoice in December for previous year’s costs. As a business, you would normally want to end your financial year accounting no later than 6 months after the end of the business year.

Pros

- Less work month-to-month

- Predictable for a year

Cons

- Recalculations stretch over multiple years, making accounting more complicated

- Inconvenient for short leases with surprise bills long after the lease has terminated.

3. Monthly calculation and invoicing

Monthly utilities calculations and invoicing may take more work each month, but gives a very clear relationship and accounting for both parties. It used to take a lot of time and effort when things were done on paper and in Excel. That’s why Western Europe transitioned to monthly fixed cost and annual balancing. This was also motivated by longer lease terms and stable economic environment where the parties to the lease did not have to worry about the counterpart being able to fill their responsibilities months after the end of the contract.

Pros

- Transparent and clear

- No long-term commitment required

Cons

- Without proper tools, may take more work monthly

- May be difficult to adopt if the monthly fixed rate has become standard.

Common practices for calculating utilities always depend on many factors and finding the right solution is a balancing act. Even though monthly calculations are the clearest and most flexible way to go for all parties, it used to be burdensome for the landlord. That’s why long leases, monthly fixed cost and annual balancing tended to be the norm in economically stable countries.

Today, however, leases are getting shorter all over the world again, and both tenants and landlords value flexibility. That’s why it might be a good idea to switch to monthly utilities calculations even in countries where it hasn’t been a common practice. With modern automation tools like Moderan, monthly calculation and invoicing is no longer the headache it used to be.

Moderan makes monthly utilities calculations easier and faster than ever. You only have to insert the charges by the service providers, import the meter readings and review the results. This can be done in a matter of minutes even for larger properties. This way your accounting practices are always transparent and your cash flow is well managed. In the changing real estate market, digital partners help you meet the tenants’ expectations for flexibility.

———————————-

Do you want to learn about how to automate the complexity in CRE utilities management?

Watch our video: (and follow the Moderan YouTube channel to stay up-to-date)