Commercial real estate leases are getting shorter. How can landlords use that to their advantage?

Companies of all industries and sizes are demanding shorter, more flexible real estate leases. But you can’t blame it all on the pandemic. COVID just put this irreversible process to a fast-forward. Find out what the future of commercial real estate holds and how landlords can leverage it in their favour.

Commercial real estate leases were already getting shorter before the COVID-19.

Remember the days of 10+ year unbreakable leases in office buildings? Well, they’re gone and not coming back.

The trend of shorter leases was initially driven by smaller quickly growing firms. Coworking spaces based their businesses on companies that couldn’t afford large office spaces in top office buildings and also needed the flexibility to scale up or down quickly.

But as the business world kept changing quicker and quicker, all kinds of companies started to demand more flexibility. And not just shorter terms, but also more services. From pop-up stores to stock-offices, you can see this trend in all commercial real estate sectors.

Shared workspaces company WeWork says that over 50% of its core revenue comes from companies with more than 500 employees.

Today, commercial real estate is starting to look more like hotels than long-term “homes”.

As previously said, all this was already happening before the pandemic. Sure, COVID has put an unexpected twist to the future of office spaces. Some people think that as soon as the vaccine is in place, everything will turn back to normal. Others say that people will keep working from home and office demand will fall drastically. There’s no certain way to say how and when this will eventually play out.

But as the only certain thing is the uncertainty, it’s understandable that companies want to keep their options open. This can only mean even shorter and more flexible leases.

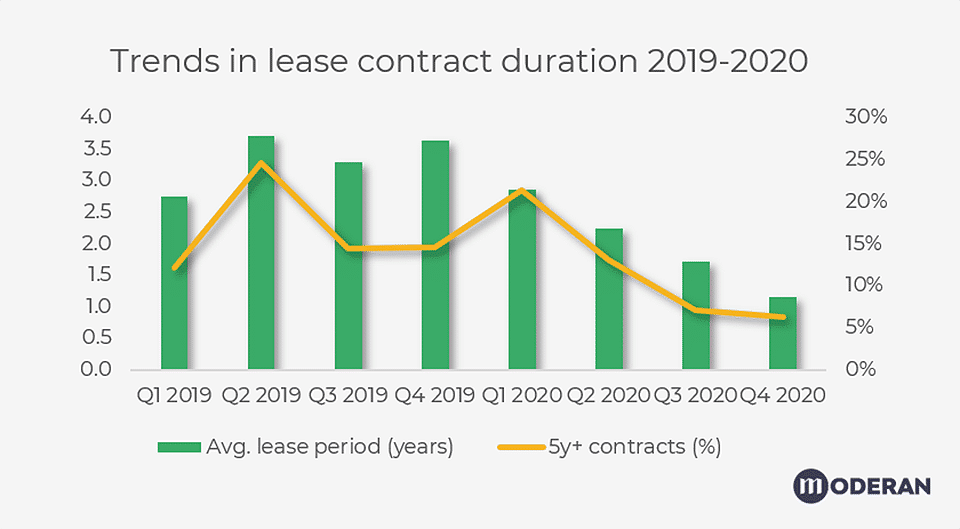

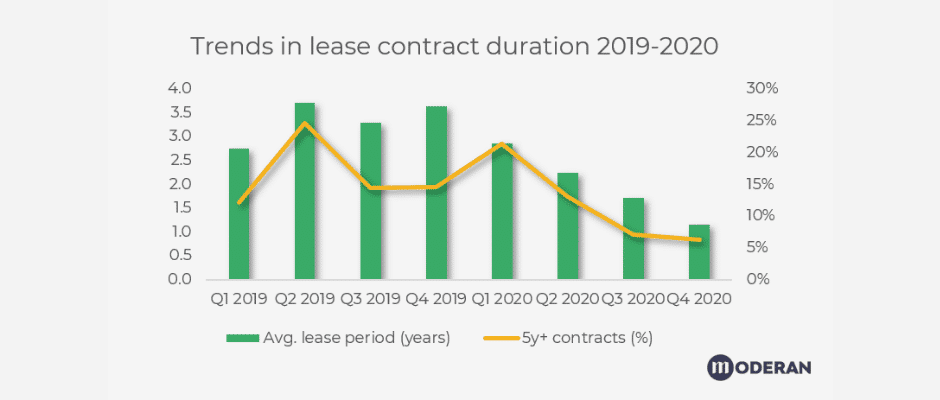

This commercial real estate trend is also clearly visible in Moderan data.

The average length of new leases signed in 2019 used to fluctuate between 2,5-3,5 years. The start of the crisis in Q2 2020 reveals a change. From there on we see a clear downward trend for the rest of the year with new leases being signed for less than 2 years on average, making them roughly 30% shorter than before.

This means that companies are still signing leases, and do extend them later, but they are clearly going for the more flexible options.

What will this all mean to the landlords?

Managing your assets proactively is more important than ever. You need to be able to monitor your leases, adjust pricing, and advertise vacant spaces on a weekly basis (rather than yearly). You must be able to analyse what works well and what doesn’t.

Is there an upside? Luckily, yes. If you manage your portfolio right, you can charge higher prices for your assets. The tenants may want less space and shorter leases, but they are ready to pay for it. So you just need proper reminders to effectively manage lease extensions and clear overview of all upcoming vacancies in your properties. Good thing there are tools for that already available!

Are you looking to upgrade your property management? We’ve got the tools for you. Moderan provides a real-time overview of your property portfolio that allows your team to work smarter, save time, and maximize revenue.

Do you want to learn about ways to improve your CRE lease management with software?

Watch our video: (and follow the Moderan YouTube channel to stay up-to-date)